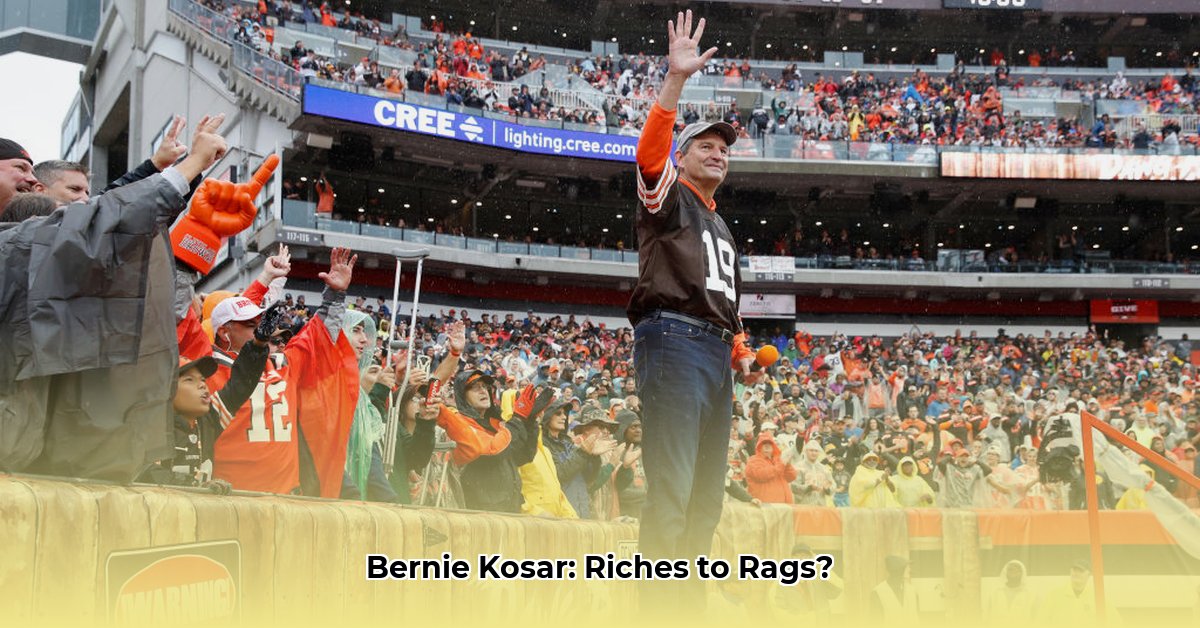

Bernie Kosar, the legendary Cleveland Browns quarterback, epitomizes a cautionary tale for athletes and high-earners alike. His story isn't simply about a fluctuating net worth; it's a compelling case study in financial mismanagement, highlighting the critical need for proactive planning and expert guidance. This isn't merely a chronicle of lost millions; it's a roadmap for avoiding the pitfalls that ensnared even a star player like Kosar, offering actionable strategies for securing long-term financial well-being. How did a man who earned an estimated $20 million during his NFL career end up facing financial hardship? The answer is multifaceted and reveals crucial lessons for anyone managing significant wealth. To learn more about investigating net worth, check out this helpful resource: Net Worth Lookup.

The Rise and Fall: A Perfect Storm of Factors

Kosar's financial struggles weren't the result of a single catastrophic event. Instead, they were the culmination of several interconnected factors. While unwise investments undoubtedly played a role, family dynamics significantly exacerbated his existing financial vulnerabilities. The exact extent of family influence on his financial decline is unclear, but it undeniably accelerated an already concerning trend. Risky business ventures, such as his involvement with the Florida Panthers and Arena Football League, further compounded his difficulties. These weren’t isolated incidents; they formed part of a downward spiral that gradually eroded his substantial fortune. This case showcases how even extraordinary success on the field doesn’t automatically translate into financial security without a robust, well-defined strategy.

Key Takeaways from Kosar's Experience:

- The critical need for independent, expert financial advice: Navigating the complexities of wealth management, particularly the pressures faced by high-profile individuals, necessitates skilled guidance.

- The paramount importance of diversification: Concentrating investments in high-risk ventures is a recipe for disaster. A diversified portfolio offers resilience against market volatility.

- The necessity of establishing clear financial boundaries with family: While family loyalty is commendable, blurring the lines between personal and family finances often leads to significant problems.

These are not mere suggestions; they are essential strategies that could have significantly altered Kosar's financial trajectory. His story serves as a powerful reminder of a common yet tragically overlooked issue among high-earning athletes: the absence of a robust, long-term financial plan.

Charting a Safer Course: Actionable Intelligence

Imagine suddenly acquiring millions. How would you handle it? Many, like Kosar, are unprepared for the financial implications of sudden success. This section outlines proactive steps to prevent a similar fate. These strategies are designed for athletes, but their principles apply universally to anyone managing significant wealth.

Actionable Steps for Athletes:

- Seek Professional Help Immediately: Don’t wait until wealth accumulates; engage an independent financial advisor before significant earnings begin. This proactive approach provides a solid foundation for future financial management.

- Develop a Comprehensive Financial Plan: This isn't a wish list; it's a detailed roadmap encompassing budgeting, investment strategies, risk management, and retirement planning. A comprehensive plan acts as a compass, guiding your financial decisions.

- Diversify Your Investments: Spread your assets across diverse asset classes (stocks, bonds, real estate, etc.) to mitigate risk and protect against market downturns. Consult with your advisor regarding your personal risk tolerance.

- Set Clear Financial Boundaries with Family: Establish firm boundaries to protect your assets from potential misuse and maintain financial independence. Consider creating legally binding agreements.

- Continuous Financial Education: The financial landscape constantly evolves; embrace ongoing learning to stay informed and adapt your strategies as needed.

Actionable Steps for Financial Advisors:

- Proactive Education: Educate your client on not only the present value of their wealth but also on long-term financial planning, including retirement, tax optimization, and risk mitigation.

- Personalized Strategies: High-income volatility necessitates tailored strategies that account for this unique circumstance, including risk tolerance measures and diversification strategies.

- Building a Solid Foundation: Guide clients in establishing a diversified foundation for future financial security. This emphasis on long-term stability trumps short-term gains.

- Transparency and Ethics: Maintain the utmost ethical standards. Transparency and proactive conflict avoidance are essential for building client trust.

Actionable Steps for Sports Organizations:

- Financial Literacy Programs: Integrate mandatory financial education into athlete development programs to equip emerging athletes with the tools for effective financial management.

- Access to Vetted Advisors: Provide athletes with easy access to reputable and trustworthy financial advisors who understand the unique circumstances of high-earning athletes.

- Improved Contract Negotiations: Strengthen contract negotiation processes to ensure players' financial interests are protected.

Mitigating Risk: A Strategic Approach

The vulnerability of athletes to financial mismanagement is a systemic issue. A simple risk assessment matrix highlights key vulnerabilities and mitigation strategies:

| Risk Category | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Family Mismanagement | High | Catastrophic | Independent financial advisor; legally binding agreements |

| Unsuccessful Investments | Medium | High | Diversified portfolio; expert investment advice |

| Contract Disputes | Low | Medium | Thorough legal review; experienced representation |

| Tax Liability Issues | Medium | High | Qualified tax specialist; proactive tax planning |

This vulnerability highlights a need for stronger regulatory oversight. Experts suggest stricter regulations surrounding athlete contracts and financial affairs could be beneficial. Increased transparency and improved financial literacy programs are crucial preventative measures.

Conclusion: A Legacy of Lessons

Bernie Kosar's story serves as a powerful case study in the critical need for proactive financial planning. His experience underscores that financial success requires as much diligence and strategy as athletic achievements. By learning from his misteps, athletes and high-earners can chart a more secure financial future. The proactive steps mentioned above are not merely recommendations; they are essential tools for building a lasting legacy of financial security. The wealth achieved through athletic success should not be a fleeting moment of prosperity, but rather a cornerstone for a financially secure future.